- Staff

- #1

- 57,155

- 24,332

Facebook Said to Plan IPO at $100B Valuation

Facebook Inc. is considering raising about $10 billion in an initial public offering that would value the social-networking site at more than $100 billion, a person with knowledge of the matter said.

Facebook may file for an IPO before the end of the year, said the person, who asked not to be identified because the deliberations are private. Exact timing for the filing hasn’t been determined, the person said.

At $10 billion, the offering would raise more money than any other technology IPO, a sign investors are eager to get a piece of the top social-networking company. The amount would dwarf that of the previous record holder, Infineon Technologies AG, which generated $5.23 billion in its 1999 debut. Agere Systems Inc. raised $4.14 billion in 2000, putting it second.

Facebook’s $100 billion valuation would be twice as high as it was in January, when the company announced a $1.5 billion investment from Goldman Sachs Group Inc. (GS) and other backers at a worth of $50 billion. Facebook is currently pegged at $66.6 billion on SharesPost Inc., which handles trading of closely held companies.

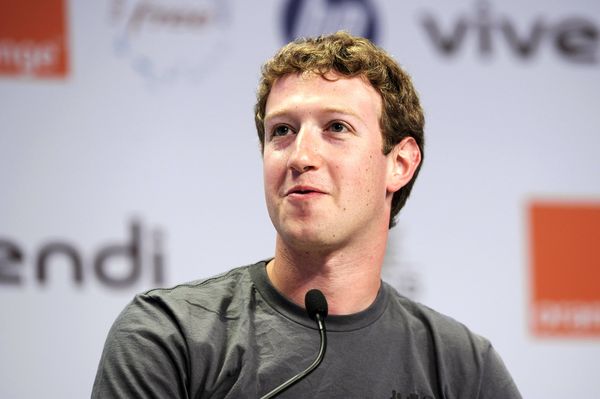

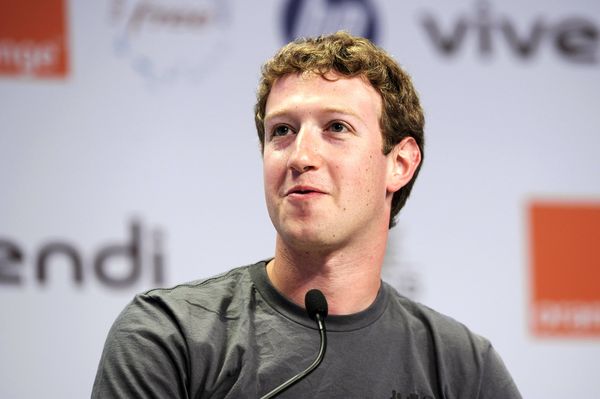

Facebook expects to be required by U.S. regulators to disclose financial results by April 30, 2012, if it doesn’t go public by then, the company said in January. The social- networking company decided to wait until 2012 for its IPO to give Chief Executive Officer Mark Zuckerberg more time to gain users and boost sales, three people said last year.

Jonathan Thaw, a spokesman for Palo Alto, California-based Facebook, declined to comment. The Wall Street Journal reported earlier today that Facebook is discussing a $10 billion IPO with a valuation of more than $100 billion. The company aims to go public between April and June, the Journal said.

Facebook Inc. is considering raising about $10 billion in an initial public offering that would value the social-networking site at more than $100 billion, a person with knowledge of the matter said.

Facebook may file for an IPO before the end of the year, said the person, who asked not to be identified because the deliberations are private. Exact timing for the filing hasn’t been determined, the person said.

At $10 billion, the offering would raise more money than any other technology IPO, a sign investors are eager to get a piece of the top social-networking company. The amount would dwarf that of the previous record holder, Infineon Technologies AG, which generated $5.23 billion in its 1999 debut. Agere Systems Inc. raised $4.14 billion in 2000, putting it second.

Facebook’s $100 billion valuation would be twice as high as it was in January, when the company announced a $1.5 billion investment from Goldman Sachs Group Inc. (GS) and other backers at a worth of $50 billion. Facebook is currently pegged at $66.6 billion on SharesPost Inc., which handles trading of closely held companies.

Facebook expects to be required by U.S. regulators to disclose financial results by April 30, 2012, if it doesn’t go public by then, the company said in January. The social- networking company decided to wait until 2012 for its IPO to give Chief Executive Officer Mark Zuckerberg more time to gain users and boost sales, three people said last year.

Jonathan Thaw, a spokesman for Palo Alto, California-based Facebook, declined to comment. The Wall Street Journal reported earlier today that Facebook is discussing a $10 billion IPO with a valuation of more than $100 billion. The company aims to go public between April and June, the Journal said.