Hi everyone. I leased my 2013 Si Sedan a little over a year ago in May 2013. I could really use some insight into the world of leasing, however. This was my first lease, and to be honest, I was so giddy and excited to get that new Si that I didn't really put up much of a fight with my lease terms.

My plan was and hopefully (depending on the info. I collect in this thread) still is to go ahead and keep paying this car after my 3 year lease is up until I own it. I went into this knowing this would be my car for the next 7-9 years.

So what I would like to know is:

1. Does the money I pay monthly towards my lease go towards reducing the final cost of my Si once my 3 year lease is up?

2. Can I switch from a lease to a financing agreement now/during my lease or must I wait until my lease is up?

3. If I decide to wait for my lease to be up, would I have a chance at getting a better deal than trying to finance it mid lease (if this is an option)

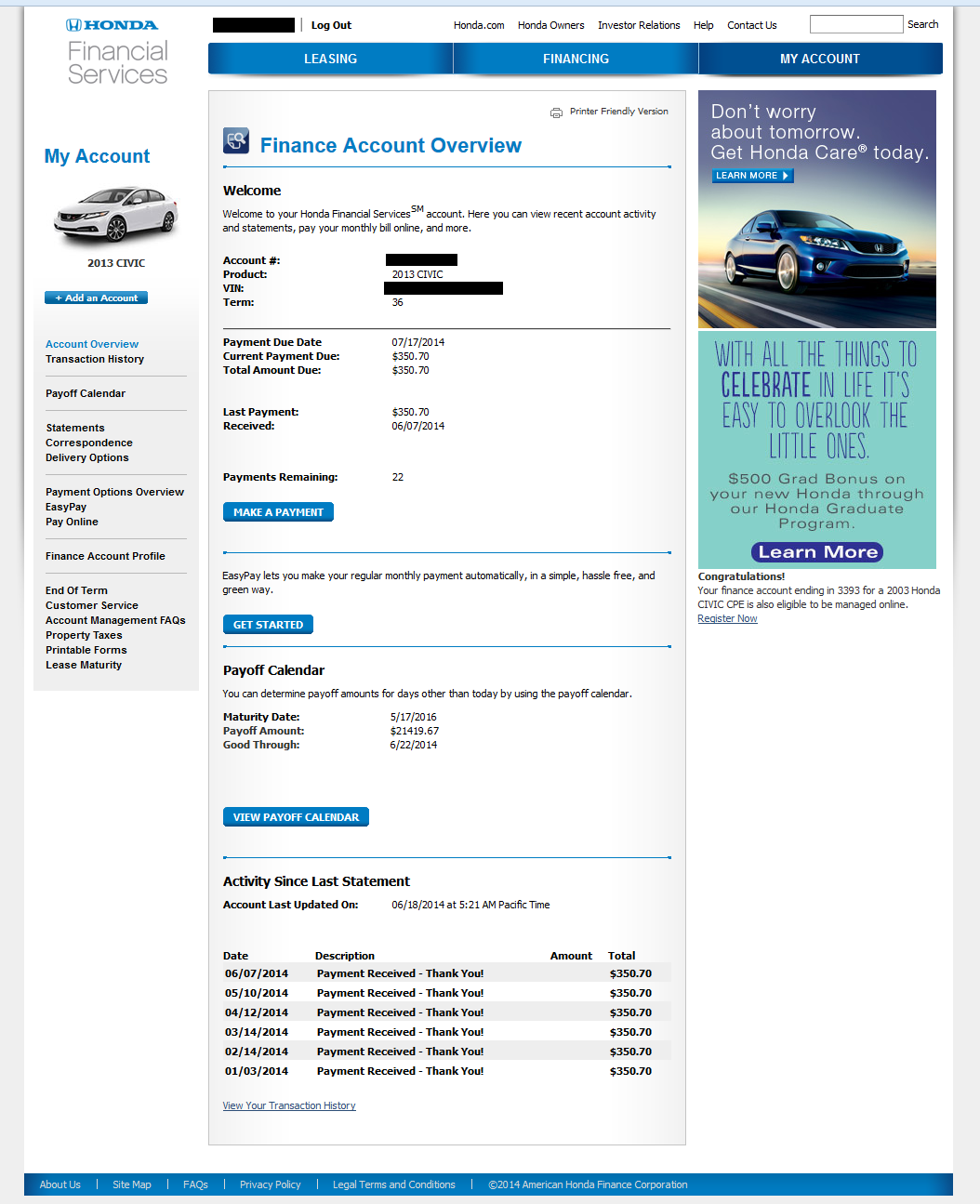

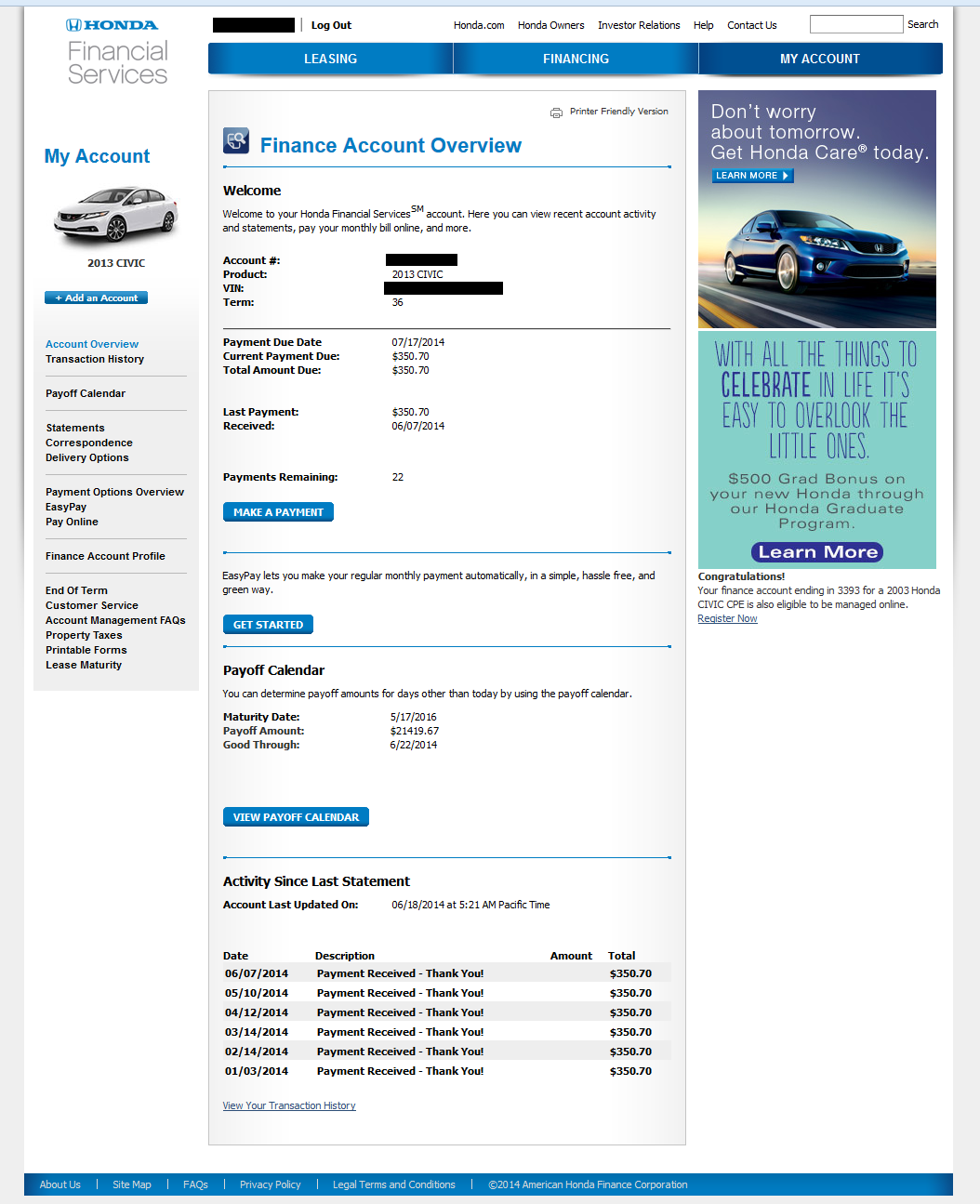

4. How does the Payoff Calendar work? When I tried checking to see if my final cost goes down for the next month, it went up $80 instead. I'm assuming this is because of interest?

Any help would be appreciated in helping me determine if I should keep the car or turn it in. Thanks!

My plan was and hopefully (depending on the info. I collect in this thread) still is to go ahead and keep paying this car after my 3 year lease is up until I own it. I went into this knowing this would be my car for the next 7-9 years.

So what I would like to know is:

1. Does the money I pay monthly towards my lease go towards reducing the final cost of my Si once my 3 year lease is up?

2. Can I switch from a lease to a financing agreement now/during my lease or must I wait until my lease is up?

3. If I decide to wait for my lease to be up, would I have a chance at getting a better deal than trying to finance it mid lease (if this is an option)

4. How does the Payoff Calendar work? When I tried checking to see if my final cost goes down for the next month, it went up $80 instead. I'm assuming this is because of interest?

Any help would be appreciated in helping me determine if I should keep the car or turn it in. Thanks!